pocket2

Understanding the Countries Prohibited by Pocket Option

Understanding the Countries Prohibited by Pocket Option

Pocket Option is a popular trading platform that has garnered a substantial following due to its user-friendly interface and diverse trading options. However, like many financial services, it operates under various international regulations, which can lead to restrictions in certain countries. To gain a deeper understanding, we will discuss the countries prohibited by Pocket Option, the reasons behind these restrictions, and the implications for traders. For a detailed list of prohibited countries, you can visit Countries Prohibited by Pocket Option https://pocket-option.support/paises-prohibidos/.

What is Pocket Option?

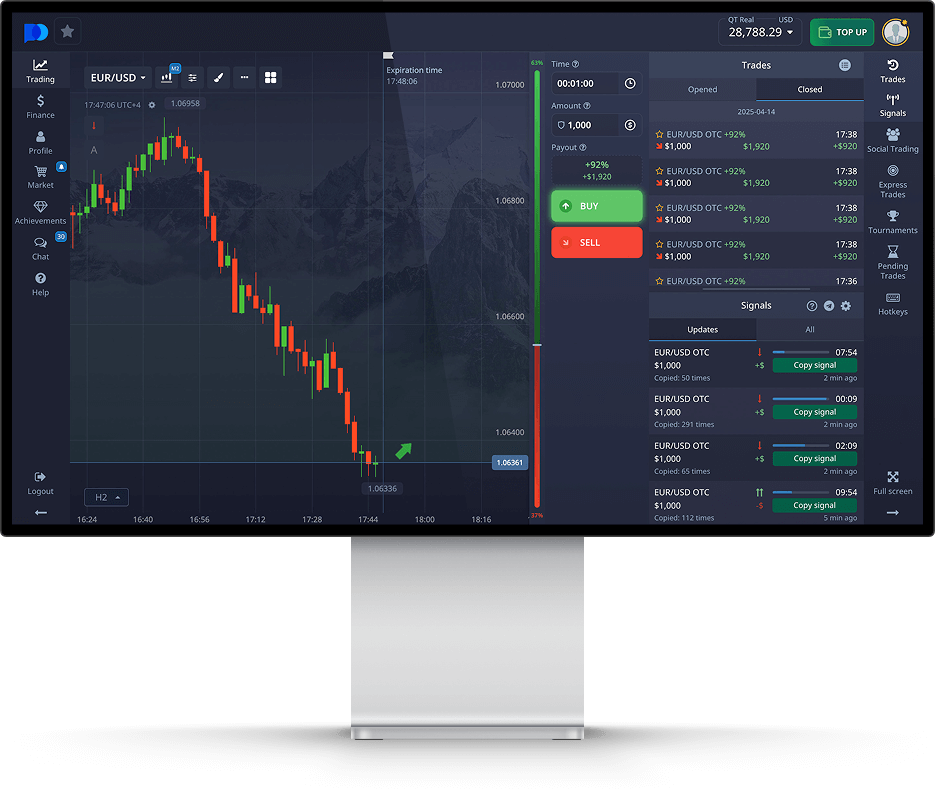

Pocket Option is an online trading platform that specializes in binary options and Forex trading. Launched in 2017, the platform has quickly become known for its simplicity, allowing users to trade various assets, including stocks, commodities, currencies, and cryptocurrencies. Its attractive features, including a demo account for practice, a wide range of trading tools, and bonuses for new users, contribute to its popularity.

Legal Framework and Compliance

The global landscape of online trading is complex and varied, with different countries imposing their own regulations on financial trading services. Pocket Option, as a responsible platform, must comply with these regulations to operate legally in various jurisdictions. This compliance often results in the need to prohibit users from certain countries where legal constraints may pose challenges for both the platform and its users.

Countries Prohibited by Pocket Option

One of the critical aspects of trading on Pocket Option is understanding where the platform is legally allowed to operate. As of the latest updates, several countries have been identified where Pocket Option does not provide services. These prohibitions are primarily due to local laws regarding online trading, binary options, and financial services. Here are some of the notable countries where Pocket Option is prohibited:

- United States: The U.S. has stringent regulations regarding binary options and forex trading. The Commodity Futures Trading Commission (CFTC) heavily regulates these markets, resulting in many platforms, including Pocket Option, not servicing U.S. residents.

- Canada: Similar to the U.S., Canada has specific regulations that vary by province. While some provinces may allow certain trading practices, others impose restrictions, leading to Pocket Option’s decision to prohibit users from this region.

- Australia: Australia’s securities market is regulated by the Australian Securities and Investments Commission (ASIC), which imposes strict licensing requirements that may not align with Pocket Option’s operational model.

- Israel: The Israeli government has taken significant steps to regulate binary options, leading to a complete ban on the activity within its borders. Consequently, platforms like Pocket Option cannot offer their services to Israeli residents.

- New Zealand: With a robust regulatory environment governed by the Financial Markets Authority (FMA), New Zealand has seen considerable scrutiny of binary options, leading to restrictions on platforms that do not comply with local laws.

- Other Countries: In addition to the aforementioned countries, Pocket Option also restricts services in regions where local laws do not permit online trading, including specific Middle Eastern nations and regions under heavy regulatory scrutiny.

Reasons for Prohibition

The reasons behind these prohibitions are multifaceted. Primarily, they revolve around the protection of consumers and the enforcement of legal standards. Here are some reasons why certain countries could be restricted:

- Regulatory Compliance: Each country has its own regulatory framework for financial services, and failure to comply with these regulations can result in severe penalties for trading platforms.

- Consumer Protection: Governments implement these regulations to protect consumers from fraud, misleading practices, and financial loss. Restricting access to certain platforms helps to mitigate these risks.

- Legal Implications: Operating in unauthorized jurisdictions can expose trading platforms to legal challenges and lawsuits, leading to potential financial liabilities.

- Market Integrity: Regulation helps maintain a fair and transparent trading environment, ensuring that all market participants are treated equitably.

Impact on Traders

The prohibition of Pocket Option in certain countries significantly affects traders. For individuals in these regions who wish to engage in online trading, the options become severely limited. Here are a few implications:

- Lack of Access: Traders may find themselves unable to access a user-friendly platform like Pocket Option, limiting their trading opportunities.

- Forced Alternatives: Traders will be compelled to seek alternative platforms, which may not offer the same features, benefits, or security as Pocket Option.

- Increase in Risks: Using unregulated or lesser-known platforms can expose traders to heightened risks, including potential scams and a lack of consumer protection.

- Dissatisfaction and Frustration: The restrictions can lead to dissatisfaction among users who may feel unfairly treated by their government or the trading platform.

Conclusion

In summary, understanding the countries prohibited by Pocket Option is crucial for potential traders looking to engage in online trading. While the restrictions may seem limiting, they are primarily in place to protect consumers and adhere to legal standards. For those in prohibited regions, exploring alternative platforms and staying informed about local regulations is essential for engaging in safe and secure trading practices. As the landscape of online trading continues to evolve, it will be interesting to see how regulations adapt and which countries may eventually lift restrictions on platforms like Pocket Option.

For more information and updates regarding the countries prohibited by Pocket Option, be sure to check out official resources and their support channels.